The price of gold is normally determined by a combination of global real interest rates, the value of the U.S. dollar and risk aversion (so-called 'safe haven' demand) plus net supply from new production and changes in stocks held by central banks.

Calculate them and you get a two-year chart of gold which looks like this

While retail demand from China and India are strong drivers of gold prices, HSBC believes that the arrival of central banks into the fray will mark a new chapter for growth in gold prices.

The change in central bank demand is an important structural difference in net supply and demand conditions relative to the past and it seems set to continue. Central banks in the emerging world remain keen to diversify away from the US dollar and the attraction of precious metals, including gold is unlikely to fade anytime soon."

"Changes in central bank stocks of gold can make a bigger difference to net supply than changes in production because of the huge size of stocks relative to annual production. Central banks are the holders of the largest stock piles of gold. For many years they were net sellers of gold. They preferred to own assets that generated a running yield because the focus was on improving the rate of return on their assets," says HSBC.

Concern about dollar weakness and debasement from ultra loose monetary policy has turned central banks into a source of net demand for gold not net supply. Central banks in India, China, Russia and Mexico have recently been buyers of gold in an effort to diversify their foreign exchange reserves away from excessive dependence on US treasuries and other US dollar-denominated assets.

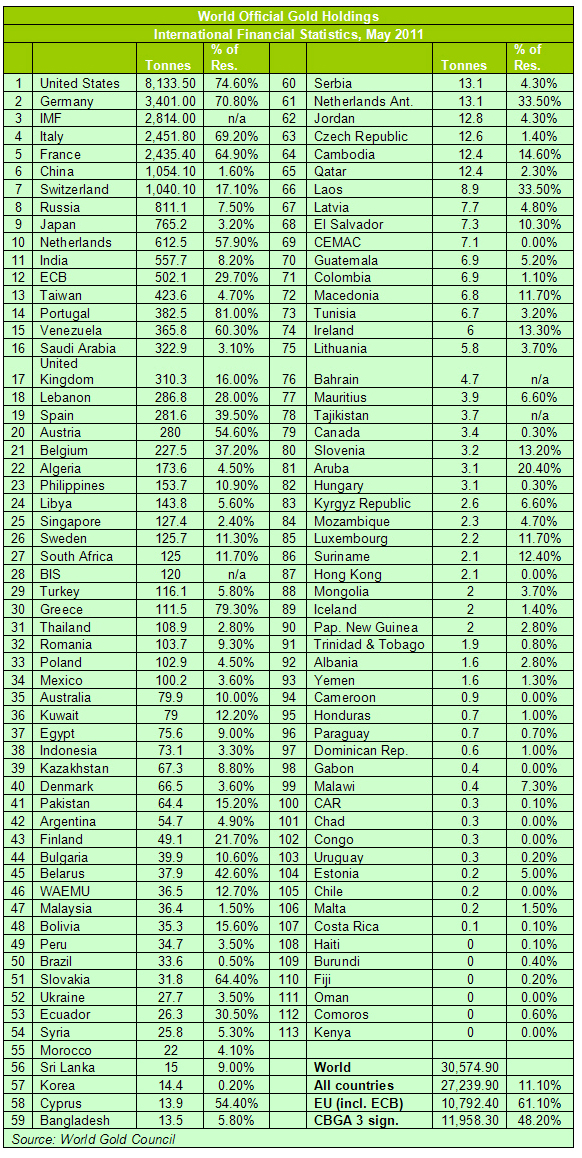

The figures from World Gold CouncilWorld Gold CouncilLoading... confirm that trend.

"Significant purchases by central banks across a number of regions in the first quarter reinforced gold's vital role as a reserve asset. Purchases by central banks jumped to 129.0 tonnes (US$5.7-billion), more than the total for 2010 as a whole," says WGCWGCLoading..., which believes 2011 will see more central banks turn to gold purchasing programmes as a means of diversifying their reserves.

Central banks of emerging economies remain under weight in their gold hoardings and WGC expects the rebalancing to continue (see chart).

The growth will be largely driven by the People's Bank of China (PBOC), the country's central bank, which is already the sixth largest official holder of gold. Still, gold is a mere 1.6% of its overall reserves and the statements coming out of the PBOC suggest that it views gold as a strong investment alternative to offset rising inflation and global instability.

The growth will be largely driven by the People's Bank of China (PBOC), the country's central bank, which is already the sixth largest official holder of gold. Still, gold is a mere 1.6% of its overall reserves and the statements coming out of the PBOC suggest that it views gold as a strong investment alternative to offset rising inflation and global instability.Apart from central banks, investors are also piling in. Despite the high prices, demand for gold in the first quarter rose by 100 tonnes, to reach 981.3 tonnes, worth $43.7-billion.

"Much of the 100-tonne increase in demand was due to strong growth in the investment sector. We believe that suitable conditions remain in place to ensure that investment demand will maintain its solid growth in the coming quarters." ( source www.zawya.com ) For the latest updates PRESS CTR + D or visit Stock Market news Today

No comments:

Post a Comment